"Unlock Financial Freedom: Get Your Loan Online Instant Approval Today!"

#### Loan Online InstantIn today's fast-paced world, financial needs can arise unexpectedly. Whether it's for medical emergencies, home repairs, or unexpect……

#### Loan Online Instant

In today's fast-paced world, financial needs can arise unexpectedly. Whether it's for medical emergencies, home repairs, or unexpected bills, having quick access to funds can make a significant difference. This is where the concept of a loan online instant comes into play, offering a convenient solution for those in need of immediate financial assistance.

#### What is a Loan Online Instant?

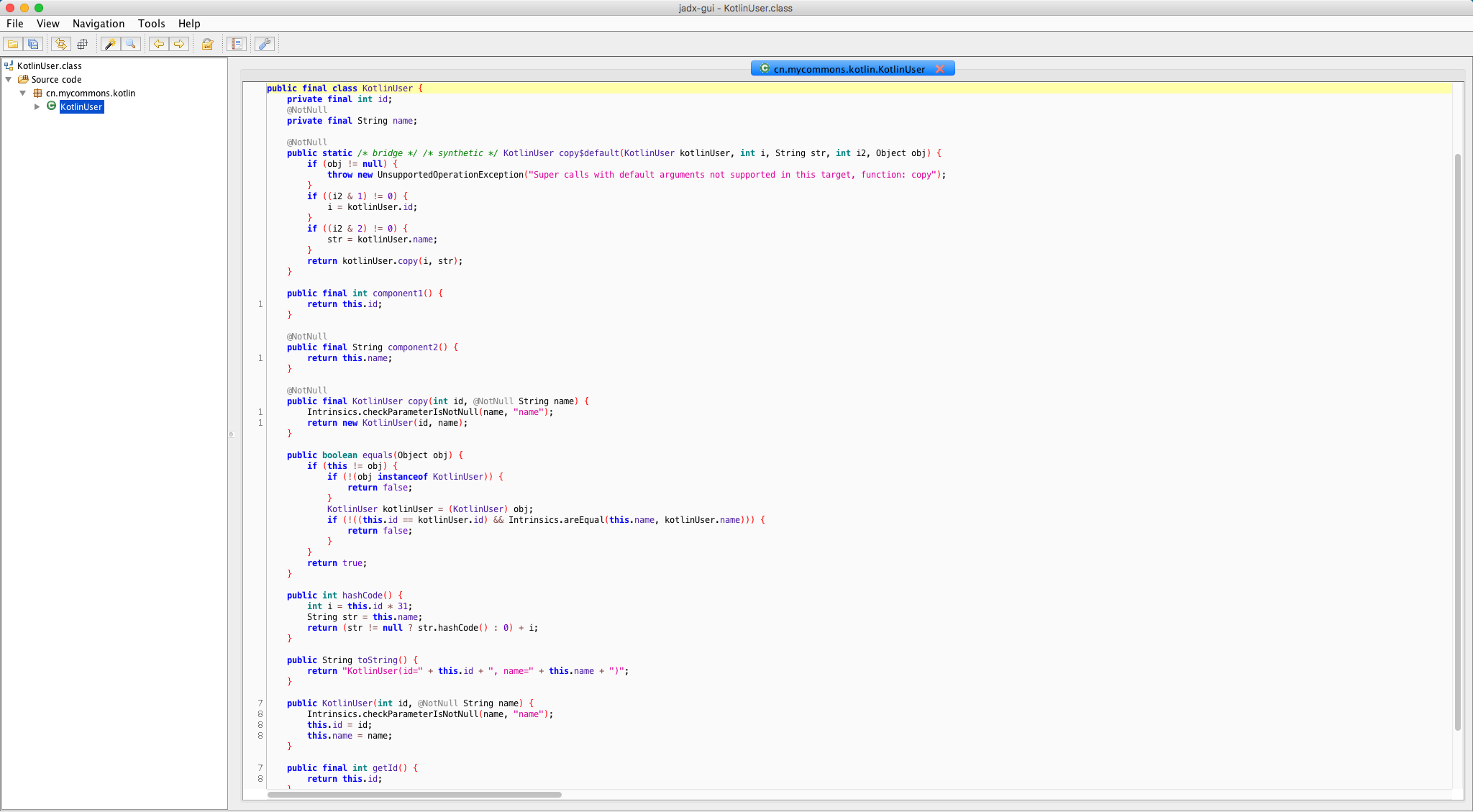

A loan online instant is a type of loan that allows borrowers to apply and receive approval within a short time frame, often within minutes. The process is typically done through an online platform, eliminating the need for lengthy paperwork and in-person visits to banks or financial institutions. This streamlined approach makes it an attractive option for individuals who require quick access to funds without the hassle of traditional loan processes.

#### How Does It Work?

Applying for a loan online instant is straightforward. Borrowers can visit a lender's website, fill out a simple application form, and submit their information. Most lenders require basic personal details, income information, and sometimes a credit check. Once the application is submitted, borrowers can receive an instant decision regarding their loan approval.

If approved, the funds are typically deposited directly into the borrower's bank account within a few hours or by the next business day. This rapid turnaround time is one of the primary advantages of loan online instant options, making them ideal for urgent financial needs.

#### Benefits of Loan Online Instant

1. **Speed and Convenience**: The most significant advantage of a loan online instant is the speed at which funds can be accessed. Borrowers can complete the application from the comfort of their homes without the need to wait in long lines at banks.

2. **Accessibility**: Online loans are available to a broader audience, including those with less-than-perfect credit scores. Many lenders specialize in providing loans to individuals who may not qualify for traditional bank loans.

3. **Flexible Loan Amounts**: Borrowers can often choose the amount they wish to borrow, allowing them to tailor the loan to their specific needs. Whether it's a small amount for a quick fix or a larger sum for significant expenses, options are available.

4. **Easy Repayment Options**: Most online lenders offer flexible repayment plans, allowing borrowers to choose terms that fit their financial situation. This flexibility can help borrowers manage their repayments more effectively.

#### Considerations Before Applying

While loan online instant options are convenient, borrowers should consider a few factors before applying:

1. **Interest Rates**: Online loans can sometimes carry higher interest rates compared to traditional loans. It's essential to compare rates from different lenders to find the best deal.

2. **Fees**: Some lenders may charge origination fees or other charges that can increase the overall cost of the loan. Always read the fine print and understand the total cost of borrowing.

3. **Repayment Terms**: Ensure that the repayment terms are manageable within your budget. Defaulting on a loan can lead to additional fees and negatively impact your credit score.

4. **Lender Reputation**: Research the lender’s reputation and read reviews from previous borrowers. This can help you avoid scams and find reputable lenders.

#### Conclusion

In conclusion, a loan online instant can be a lifesaver for those facing urgent financial needs. With the ability to apply quickly and receive funds almost immediately, these loans offer a practical solution for managing unexpected expenses. However, it's crucial to approach these loans with caution, ensuring that you understand the terms and costs involved. By doing your research and making informed decisions, you can effectively leverage online loans to achieve financial stability and peace of mind.