A Step-by-Step Guide on How to Apply for a Federal Student Loan: Everything You Need to Know

---#### How to Apply for a Federal Student LoanApplying for a federal student loan can be a daunting process, but it is essential for many students seeking……

---

#### How to Apply for a Federal Student Loan

Applying for a federal student loan can be a daunting process, but it is essential for many students seeking higher education. Understanding the steps involved can simplify the process and help you secure the funding you need. Below, we will walk you through the necessary steps, important considerations, and tips to make your application as smooth as possible.

#### Understanding Federal Student Loans

Federal student loans are loans provided by the government to help students pay for their education. These loans typically have lower interest rates and more flexible repayment options compared to private loans. It's crucial to understand the different types of federal student loans available, such as Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans, as each has its own eligibility requirements and terms.

#### Step 1: Complete the FAFSA

The first step in applying for a federal student loan is to complete the Free Application for Federal Student Aid (FAFSA). This form is essential for determining your eligibility for federal student aid, including loans, grants, and work-study programs. You can complete the FAFSA online at the official website, and you will need to provide information about your financial situation, including income, assets, and family size.

#### Step 2: Gather Necessary Documents

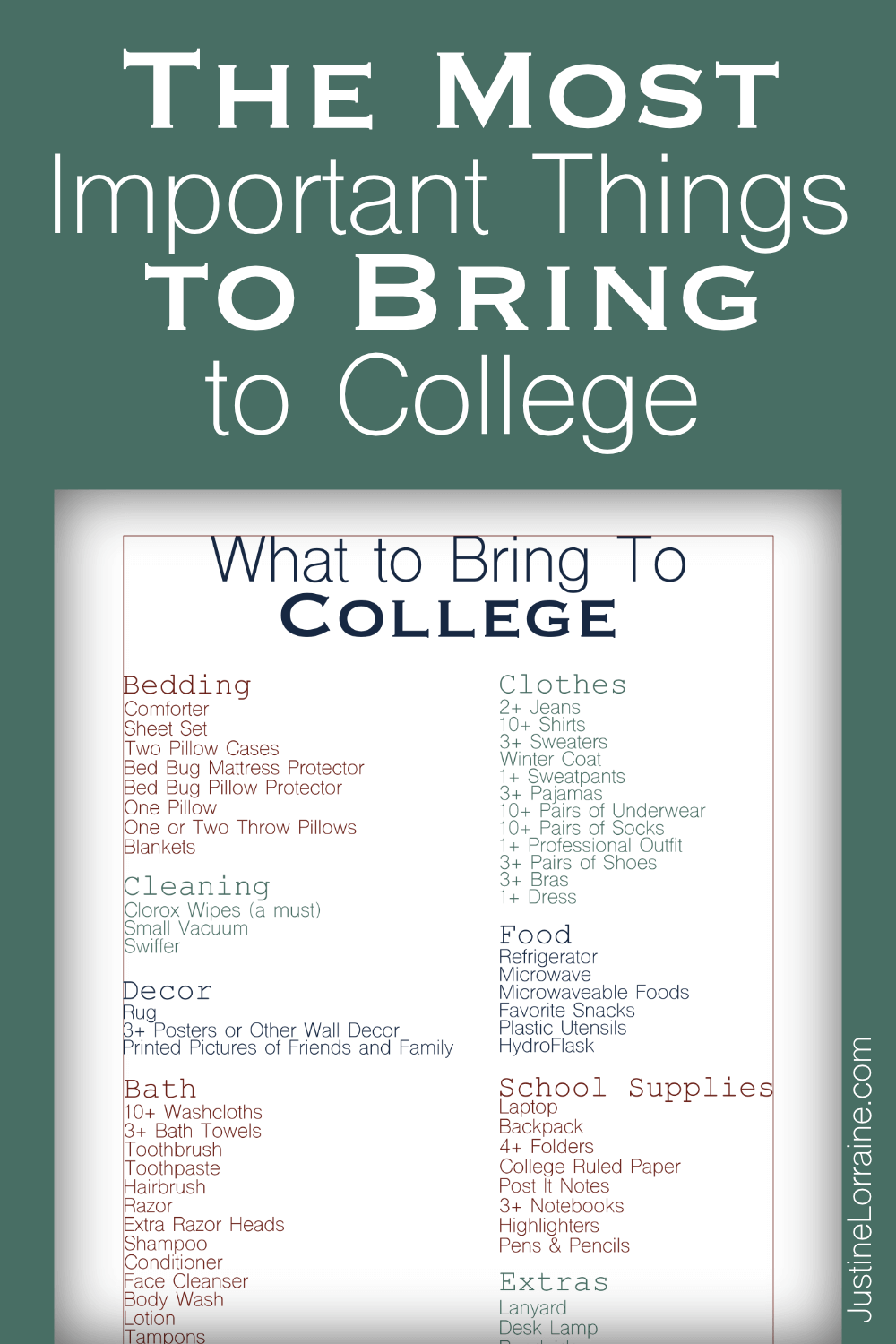

Before starting the FAFSA, gather all necessary documents, such as your Social Security number, tax returns, W-2 forms, and bank statements. If you are a dependent student, you will also need your parents' financial information. Having these documents ready will make the application process smoother and faster.

#### Step 3: Review Your Student Aid Report (SAR)

After submitting your FAFSA, you will receive a Student Aid Report (SAR), which summarizes the information you provided. Review this report carefully for any errors or discrepancies. If everything looks correct, your SAR will also include your Expected Family Contribution (EFC), which is used to determine your eligibility for federal student loans.

#### Step 4: Accept Your Loan Offer

Once your FAFSA is processed, you will receive financial aid offers from your chosen schools. Review these offers, which may include federal student loans, grants, and scholarships. You can choose to accept or decline the loan offers. If you decide to accept a federal student loan, you will need to complete additional steps, such as entrance counseling and signing a Master Promissory Note (MPN).

#### Step 5: Complete Entrance Counseling

Before receiving your federal student loan funds, you must complete entrance counseling. This online session provides important information about your loan terms, repayment options, and your rights and responsibilities as a borrower. It is designed to ensure that you understand the implications of taking out a loan.

#### Step 6: Sign the Master Promissory Note (MPN)

The Master Promissory Note (MPN) is a legal document in which you agree to repay your federal student loans and any accrued interest. By signing the MPN, you are also acknowledging that you understand the terms of your loans. This document is essential for receiving your loan funds.

#### Step 7: Manage Your Loans

Once you receive your federal student loan funds, it's important to manage them wisely. Keep track of your spending, and use the funds only for educational expenses, such as tuition, books, and living costs. Additionally, stay informed about your loan balance and repayment options.

#### Conclusion

Applying for a federal student loan is a crucial step in financing your education. By following these steps and understanding the process, you can navigate the application successfully and secure the funding you need. Remember to stay organized, keep track of deadlines, and seek assistance if you have any questions along the way. With careful planning and informed decision-making, you can make your educational goals a reality.