Understanding Pet Loans: A Comprehensive Guide to Financing Your Furry Friend's Needs

#### What Are Pet Loans?Pet loans are specialized financial products designed to help pet owners cover the costs associated with their pets' healthcare, tra……

#### What Are Pet Loans?

Pet loans are specialized financial products designed to help pet owners cover the costs associated with their pets' healthcare, training, and other expenses. These loans can be particularly useful for unexpected veterinary bills or when you want to invest in your pet's well-being, such as purchasing high-quality food, toys, or even pet insurance. Unlike traditional loans, pet loans often come with flexible terms and conditions tailored to the unique needs of pet owners.

#### Why Consider Pet Loans?

The rising costs of veterinary care and pet supplies can be overwhelming. Many pet owners find themselves in situations where they need immediate financial assistance to provide the best care for their pets. Pet loans can bridge this financial gap, allowing you to afford necessary treatments without compromising your pet's health. Additionally, pet loans can help you manage your finances better, spreading the cost of pet care over time rather than facing a large, one-time expense.

#### Types of Pet Loans

There are various types of pet loans available to cater to different needs. Some of the most common include:

1. **Personal Loans**: These are unsecured loans that can be used for any purpose, including pet expenses. They typically have fixed interest rates and repayment terms.

2. **Veterinary Financing**: Many veterinary clinics offer financing options that allow you to pay for services over time. These plans may have promotional offers, such as no interest if paid in full within a specific period.

3. **Credit Cards for Pet Expenses**: Some credit cards offer rewards or cash back on pet-related purchases. However, it's essential to be cautious about interest rates and repayment terms.

4. **Pet Insurance**: While not a loan, pet insurance can help mitigate costs associated with medical emergencies. Some policies allow for reimbursement after paying the vet upfront.

#### How to Choose the Right Pet Loan?

When selecting a pet loan, consider the following factors:

- **Interest Rates**: Compare rates from different lenders to find the most affordable option.

- **Repayment Terms**: Look for loans with flexible repayment options that fit your budget.

- **Loan Amount**: Ensure the loan amount is sufficient to cover your pet's needs.

- **Lender Reputation**: Research lenders to ensure they have a good track record and positive customer reviews.

#### Applying for a Pet Loan

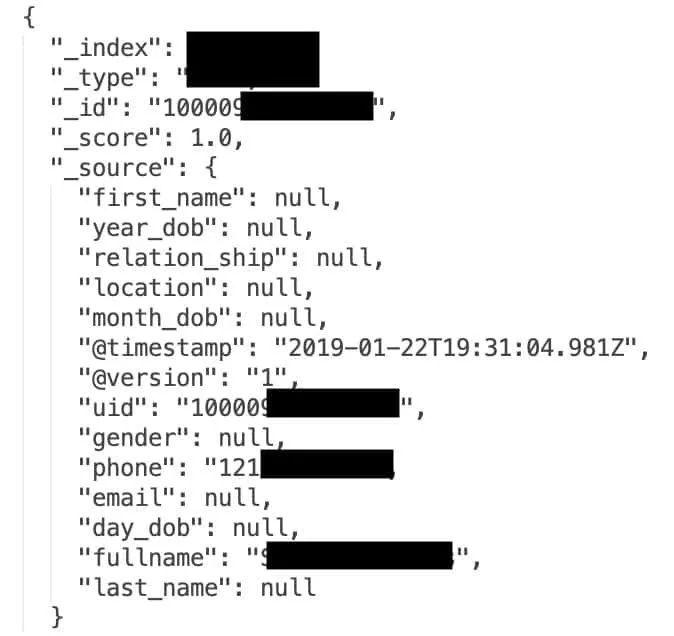

The application process for pet loans is generally straightforward. Most lenders require basic personal information, details about your income, and the purpose of the loan. Some may also check your credit score. It’s advisable to gather all necessary documents beforehand to streamline the process.

#### Conclusion

Pet loans can be a valuable resource for pet owners facing unexpected expenses or looking to provide the best possible care for their furry companions. By understanding the different types of loans available and carefully considering your options, you can make informed financial decisions that benefit both you and your pet. Always remember to read the fine print and ensure you are comfortable with the terms before committing to any loan. With the right financial planning, you can ensure your beloved pet receives the care they deserve without breaking the bank.