"Exploring Amigo Loans UK: Your Guide to Affordable Borrowing Solutions"

Guide or Summary:Understanding Amigo Loans UKBenefits of Amigo Loans UKEligibility CriteriaThe Application ProcessPotential DrawbacksAmigo Loans UK, transla……

Guide or Summary:

- Understanding Amigo Loans UK

- Benefits of Amigo Loans UK

- Eligibility Criteria

- The Application Process

- Potential Drawbacks

Amigo Loans UK, translated as "Amigo Loans UK," has become a prominent name in the UK lending landscape, particularly for those seeking guarantor loans. These loans are designed to help individuals who may struggle to secure traditional financing due to poor credit history or other financial challenges. This article will delve into the ins and outs of Amigo Loans UK, examining its benefits, eligibility criteria, application process, and potential drawbacks.

Understanding Amigo Loans UK

Amigo Loans UK specializes in providing guarantor loans, where a borrower can have a friend or family member act as a guarantor. This means that if the borrower fails to repay the loan, the guarantor is responsible for the debt. This arrangement allows individuals with less-than-perfect credit scores to access funds that they might not qualify for through conventional lenders.

Benefits of Amigo Loans UK

One of the primary advantages of Amigo Loans UK is the flexibility it offers. Borrowers can typically secure loans ranging from £1,000 to £10,000, with repayment terms of up to 60 months. This range allows for customization based on individual financial needs. Additionally, the application process is straightforward, with many applicants receiving decisions within minutes. Furthermore, the presence of a guarantor can lead to lower interest rates compared to unsecured loans, making it a more affordable option for many.

Eligibility Criteria

To qualify for Amigo Loans UK, borrowers must meet certain criteria. Firstly, applicants must be at least 18 years old and reside in the UK. They also need to have a guarantor who meets specific requirements, such as being over 21, having a good credit score, and being a UK resident. It’s essential for both the borrower and the guarantor to have a stable income to ensure that they can manage the loan repayments effectively.

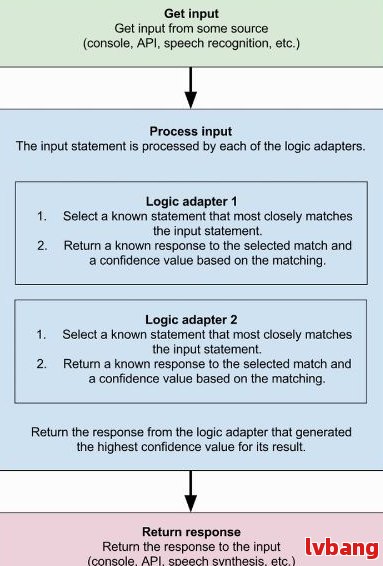

The Application Process

Applying for a loan through Amigo Loans UK is a relatively simple process. Prospective borrowers can start by filling out an online application form, providing details about their financial situation and the guarantor. Once submitted, the application is reviewed, and if approved, the terms of the loan are presented. Borrowers should carefully consider these terms before accepting the offer. After acceptance, the funds are typically transferred to the borrower’s account swiftly, allowing for quick access to cash when needed.

Potential Drawbacks

While Amigo Loans UK offers significant benefits, there are also potential drawbacks to consider. The most notable concern is the risk involved for the guarantor. If the borrower fails to make repayments, the guarantor will be held accountable, which could strain personal relationships. Additionally, interest rates, while often lower than unsecured loans, can still be relatively high, particularly for those with poor credit histories. Borrowers should ensure they fully understand the financial implications before proceeding.

In summary, Amigo Loans UK provides a valuable service for individuals who may struggle to obtain traditional loans. By leveraging the support of a guarantor, borrowers can access funds that can help them manage financial challenges or achieve personal goals. However, it is crucial to weigh the benefits against the potential risks, particularly for the guarantor. As with any financial decision, thorough research and consideration of one's circumstances are essential to ensure that borrowing remains a viable and responsible option.