Exploring No Cosigner Private Student Loans: Your Guide to Financing Education Without a Co-signer

#### No Cosigner Private Student LoansWhen it comes to financing your education, navigating the world of student loans can be daunting. For many students, e……

#### No Cosigner Private Student Loans

When it comes to financing your education, navigating the world of student loans can be daunting. For many students, especially those who may not have a creditworthy co-signer, the option of No Cosigner Private Student Loans becomes a critical consideration. These loans are designed to help students secure funding for their education without the need for a parent or guardian to co-sign, making them an attractive option for independent students or those with limited credit history.

#### Understanding No Cosigner Private Student Loans

No cosigner private student loans are financial products offered by various lenders that allow students to borrow money for their education without requiring a co-signer. This is particularly beneficial for students who may not have access to a family member or friend who can guarantee the loan. Lenders evaluate applicants based on their creditworthiness, income potential, and other factors to determine eligibility.

#### Benefits of No Cosigner Private Student Loans

One of the primary advantages of No Cosigner Private Student Loans is the independence it offers. Students can take full responsibility for their loans, which can be empowering. Additionally, these loans can often provide competitive interest rates, especially for students with good credit or those attending reputable institutions. Moreover, having a loan in your name allows you to build your credit history, which can be beneficial for future financial endeavors.

#### Eligibility Criteria for No Cosigner Private Student Loans

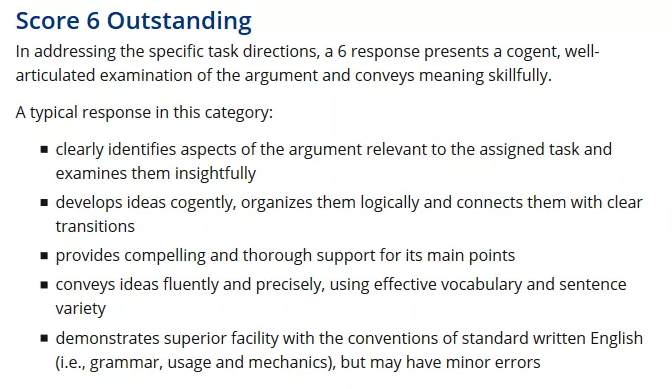

While No Cosigner Private Student Loans provide an opportunity for students without a co-signer, eligibility requirements can vary significantly among lenders. Typically, lenders will look at factors such as:

- **Credit Score**: A higher credit score can improve your chances of approval and secure better interest rates.

- **Income**: Some lenders may require proof of income or a steady job to ensure that you can manage repayments.

- **School Enrollment**: You must be enrolled at an eligible institution, as most lenders restrict loans to accredited colleges and universities.

- **Degree Program**: Certain lenders may have restrictions based on the type of degree program you are pursuing.

#### How to Apply for No Cosigner Private Student Loans

Applying for No Cosigner Private Student Loans generally involves several steps:

1. **Research Lenders**: Start by researching various lenders that offer no cosigner options. Compare interest rates, repayment terms, and any fees associated with the loans.

2. **Gather Documentation**: Prepare the necessary documentation, which may include proof of income, tax returns, and information about your school and degree program.

3. **Complete the Application**: Fill out the loan application accurately, providing all required information. Be honest about your financial situation.

4. **Review Loan Offers**: Once you receive loan offers, carefully review the terms and conditions. Look for interest rates, repayment plans, and any potential penalties.

5. **Accept the Loan**: If you find an offer that meets your needs, accept the loan and ensure you understand the repayment terms before signing.

#### Repayment Options for No Cosigner Private Student Loans

Understanding repayment options is crucial when considering No Cosigner Private Student Loans. Most lenders offer a variety of repayment plans, including:

- **Immediate Repayment**: Payments begin right after the loan is disbursed.

- **Deferred Repayment**: Students can postpone payments until after graduation, although interest may accrue during this period.

- **Interest-Only Payments**: Borrowers can choose to pay only the interest while in school, with principal payments starting after graduation.

#### Conclusion

In conclusion, No Cosigner Private Student Loans provide a viable solution for students seeking to finance their education independently. By understanding the benefits, eligibility criteria, application process, and repayment options, students can make informed decisions about their financial futures. Always remember to borrow responsibly and consider your ability to repay the loan after graduation. With the right preparation and research, you can secure the funding you need to achieve your educational goals.