Ultimate Guide to Creating a Loan Amortization Table in Excel

### Description:In the world of personal finance and lending, understanding how loans work is crucial. One of the most effective tools for managing your loa……

### Description:

In the world of personal finance and lending, understanding how loans work is crucial. One of the most effective tools for managing your loans is the **loan amortization table in Excel**. This guide will walk you through the process of creating a comprehensive loan amortization table using Excel, allowing you to track your payments and understand the breakdown of interest and principal over time.

#### What is a Loan Amortization Table?

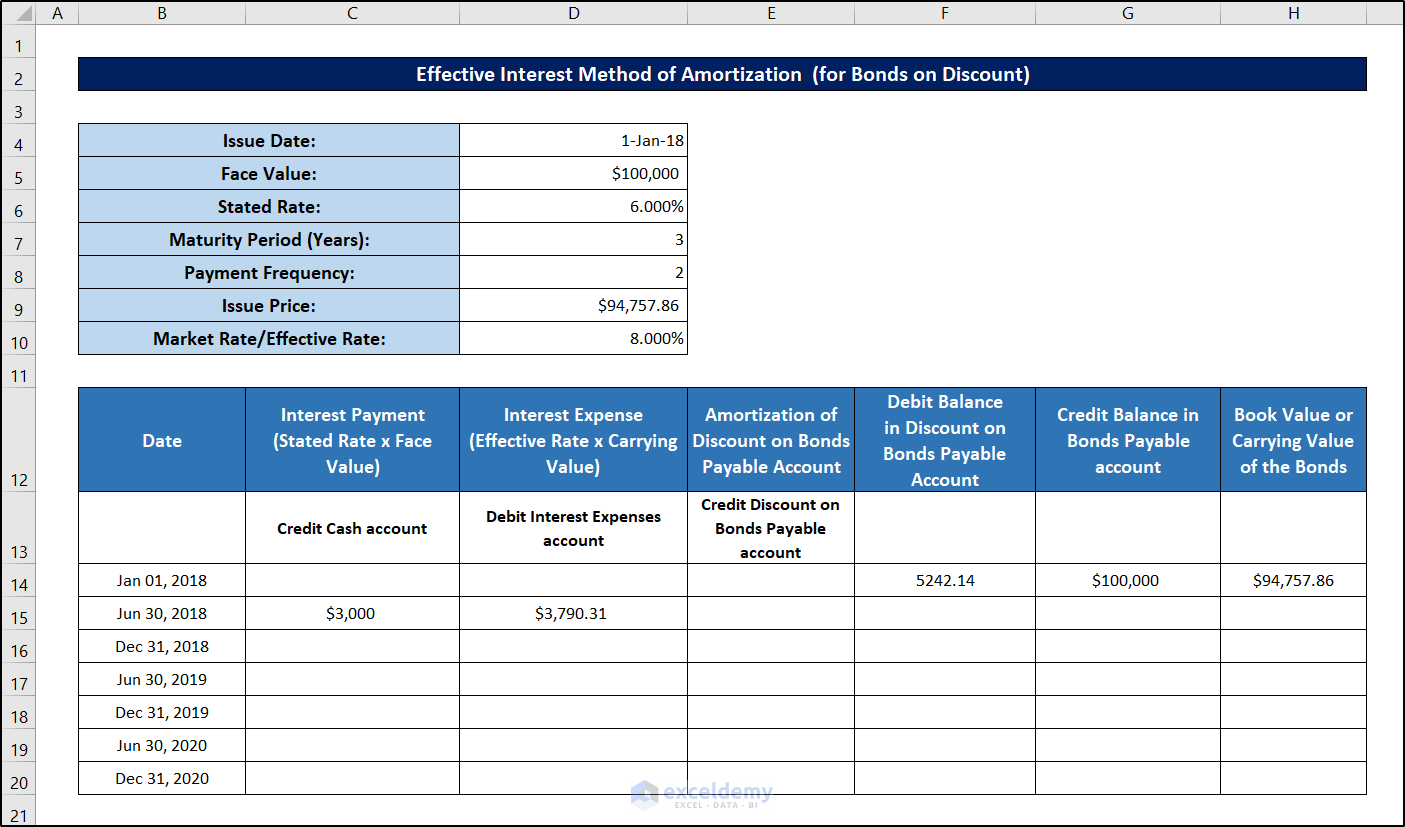

A loan amortization table is a detailed schedule that outlines each payment of a loan over its term. It shows how much of each payment goes toward interest and how much goes toward reducing the principal balance. This table is especially useful for borrowers who want to see the long-term impact of their loan decisions and plan their finances accordingly.

#### Why Use Excel for Amortization Tables?

Excel is a powerful tool that allows for customization and flexibility. By using Excel to create your loan amortization table, you can easily adjust variables such as loan amount, interest rate, and loan term. This adaptability is invaluable for anyone who wants to explore different loan scenarios or understand how changes in their financial situation may affect their repayment schedule.

#### Steps to Create a Loan Amortization Table in Excel

1. **Set Up Your Spreadsheet**: Open Excel and create a new spreadsheet. Label the first few columns to include the following headings: Payment Number, Payment Amount, Interest Payment, Principal Payment, and Remaining Balance.

2. **Input Loan Details**: In separate cells, input your loan amount, annual interest rate, and loan term in years. For example, if you have a $10,000 loan at a 5% interest rate for 3 years, enter these values in designated cells.

3. **Calculate Monthly Interest Rate**: To find the monthly interest rate, divide your annual interest rate by 12. For a 5% annual rate, the monthly rate would be 0.004167 (5% divided by 12).

4. **Calculate Monthly Payment**: Use the PMT function in Excel to calculate your monthly payment. The formula is:

```

=PMT(rate, nper, pv)

Where:

- `rate` is the monthly interest rate,

- `nper` is the total number of payments (loan term in months),

- `pv` is the present value or loan amount.

5. **Fill in the Amortization Table**: Starting with the first payment, calculate the interest payment by multiplying the remaining balance by the monthly interest rate. Then, subtract the interest payment from the total monthly payment to find the principal payment. Update the remaining balance by subtracting the principal payment from the previous balance.

6. **Repeat for Subsequent Payments**: Copy the formulas down the rows to fill in the table for each subsequent payment until the loan is paid off.

7. **Analyze Your Results**: Once your table is complete, you can easily see how much interest you will pay over the life of the loan, how your payments are structured, and how quickly you are paying down the principal.

#### Benefits of Using a Loan Amortization Table

1. **Transparency**: A loan amortization table provides clear visibility into your loan repayment process. You can see exactly how much you owe at any point in time.

2. **Financial Planning**: Understanding your loan payments can help you budget effectively. You can plan for future expenses and make informed decisions about your finances.

3. **Comparison Tool**: If you are considering multiple loans, an amortization table can help you compare the total costs and benefits of each option.

4. **Early Repayment Insights**: If you are considering paying off your loan early, the table can show you how much interest you will save by doing so.

In conclusion, creating a **loan amortization table in Excel** is a smart move for anyone looking to manage their loans effectively. With just a few steps, you can have a clear, organized view of your repayment schedule, enabling you to make better financial decisions. Whether you're a first-time borrower or an experienced one, this tool is invaluable for understanding the implications of your loan. By following this guide, you can take control of your financial future and make informed choices that align with your goals.