Unlock Your Dream Ride with Wings Financial Auto Loan

Guide or Summary:Why Choose Wings Financial Auto Loan?How to Get Started with Wings Financial Auto LoanAre you dreaming of cruising down the highway in a br……

Guide or Summary:

Are you dreaming of cruising down the highway in a brand-new car? Look no further! With wings financial auto loan, your dream of owning a vehicle can become a reality. This financial solution is designed to cater to your unique needs, offering competitive rates and flexible terms that make car ownership accessible and affordable.

Why Choose Wings Financial Auto Loan?

When it comes to financing your next vehicle, choosing the right auto loan can make all the difference. Wings Financial is committed to providing its members with top-notch service and tailored financial solutions. Here are some compelling reasons to consider a wings financial auto loan:

1. **Competitive Rates**: Wings Financial offers some of the most competitive interest rates in the market. This means you can save money over the life of your loan, making your monthly payments more manageable.

2. **Flexible Terms**: Whether you’re looking for a short-term loan or a longer repayment period, Wings Financial provides a variety of options to suit your financial situation. This flexibility allows you to choose a plan that aligns with your budget and lifestyle.

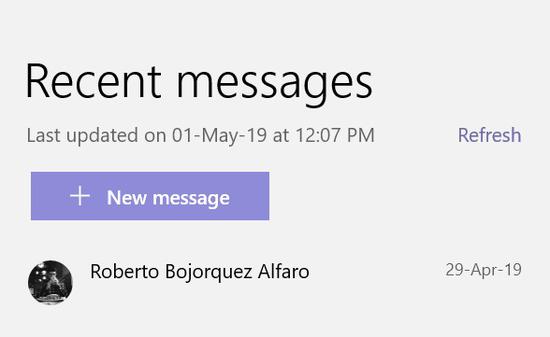

3. **Easy Application Process**: Applying for a wings financial auto loan is a breeze. Their user-friendly online application process allows you to get pre-approved quickly, so you can focus on finding the perfect vehicle without the stress of financing.

4. **Personalized Service**: At Wings Financial, you’re not just a number. Their dedicated team of financial experts is ready to help you navigate the loan process, answer your questions, and provide personalized advice to ensure you make the best decision for your financial future.

How to Get Started with Wings Financial Auto Loan

Getting started with a wings financial auto loan is simple. Here’s a step-by-step guide to help you through the process:

1. **Assess Your Budget**: Before applying, take the time to evaluate your financial situation. Determine how much you can afford for monthly payments and what type of vehicle you want to purchase.

2. **Apply Online**: Visit the Wings Financial website to fill out their straightforward online application form. You’ll need to provide some basic information, including your income, employment details, and any existing debts.

3. **Get Pre-Approved**: Once you submit your application, Wings Financial will review your information and provide you with a pre-approval amount. This will give you a clear idea of your budget when shopping for a vehicle.

4. **Shop for Your Car**: With your pre-approval in hand, you can confidently start shopping for your dream car. Whether you’re looking for a new or used vehicle, knowing your financing options will help you negotiate better deals.

5. **Finalize Your Loan**: Once you’ve chosen your vehicle, return to Wings Financial to finalize your wings financial auto loan. They will guide you through the paperwork and ensure you understand all the terms before you sign.

In conclusion, a wings financial auto loan is an excellent choice for anyone looking to finance their next vehicle. With competitive rates, flexible terms, and a commitment to personalized service, Wings Financial is dedicated to helping you achieve your automotive dreams. Don’t let financing hold you back—take the first step towards car ownership today! Whether you’re a first-time buyer or looking to upgrade, Wings Financial is here to support you every step of the way. Explore your options and drive away in the car you’ve always wanted!