Unlock Financial Freedom: How to Effectively Look Up My Student Loans for Better Management

---### Description:In today’s fast-paced world, managing student loans can feel overwhelming, but understanding how to **look up my student loans** is a cru……

---

### Description:

In today’s fast-paced world, managing student loans can feel overwhelming, but understanding how to **look up my student loans** is a crucial step toward achieving financial freedom. With student debt affecting millions of graduates, knowing how to access and manage your loans can significantly alleviate stress and help you make informed financial decisions. This guide will walk you through the process of looking up your student loans, the importance of understanding your loan details, and tips for effective management.

#### Understanding Your Student Loans

Before diving into the process of **look up my student loans**, it's essential to grasp the types of student loans you might have. Federal student loans, private loans, subsidized, and unsubsidized loans all have different terms, interest rates, and repayment plans. Knowing which types of loans you possess will help you make better financial decisions.

#### Step-by-Step Guide to Look Up My Student Loans

1. **Gather Your Information**: To **look up my student loans**, you will need certain personal information, including your Social Security number, date of birth, and any relevant account numbers.

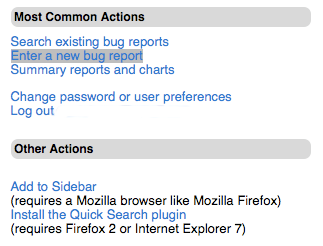

2. **Visit the National Student Loan Data System (NSLDS)**: The NSLDS is the U.S. Department of Education's central database for student aid. By visiting their website, you can access all your federal student loan information in one place.

3. **Log In Securely**: Use your FSA ID to log in. If you don’t have an FSA ID, you can create one on the Federal Student Aid website.

4. **Review Your Loan Information**: Once logged in, you can view details about your loans, including the loan types, amounts, disbursement dates, and current servicer information. This step is crucial in understanding your overall debt situation.

5. **Contact Your Loan Servicer**: If you have private loans or need more detailed information, reach out to your loan servicer directly. They can provide specific details about your loans, including payment options and refinancing opportunities.

#### Importance of Knowing Your Loan Status

Understanding how to **look up my student loans** is not just about knowing how much you owe; it’s about empowering yourself to take control of your financial future. By keeping track of your loans, you can avoid missing payments, which can lead to penalties and a negative impact on your credit score.

#### Tips for Effective Student Loan Management

- **Create a Budget**: Knowing your loan details allows you to create a budget that includes your monthly payments. This helps ensure you can manage your expenses while paying off your debt.

- **Explore Repayment Options**: Federal loans offer various repayment plans, including income-driven repayment plans that can adjust your monthly payments based on your income. Understanding these options can help you choose the best plan for your financial situation.

- **Consider Refinancing**: If you have private loans or high-interest federal loans, refinancing may be a good option to lower your interest rates. However, be sure to weigh the pros and cons, as refinancing federal loans can result in losing benefits like income-driven repayment plans.

- **Stay Informed**: Regularly checking your loan status and staying informed about changes in student loan policies can help you make timely decisions regarding your loans.

#### Conclusion

Learning how to **look up my student loans** is an empowering step towards financial literacy and responsibility. By understanding your loans, you can take control of your financial future, make informed decisions about repayment, and ultimately work towards eliminating your student debt. Remember, knowledge is power, and taking the time to understand your student loans is an investment in your financial well-being.