Comprehensive Guide: Where to Apply for Federal Student Loans and Maximize Your Financial Aid

#### Where to Apply for Federal Student LoansWhen it comes to financing your education, understanding **where to apply for federal student loans** is crucia……

#### Where to Apply for Federal Student Loans

When it comes to financing your education, understanding **where to apply for federal student loans** is crucial for students seeking financial assistance. Federal student loans are a popular option because they often come with lower interest rates and more flexible repayment terms compared to private loans. This guide will walk you through the steps to apply for federal student loans, what you need to prepare, and tips to ensure you receive the funding you need.

#### Understanding Federal Student Loans

Federal student loans are provided by the government to help students cover the cost of their education. These loans typically come with benefits such as deferment options, income-driven repayment plans, and loan forgiveness programs. The most common types of federal student loans include Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans.

#### Step-by-Step Process to Apply

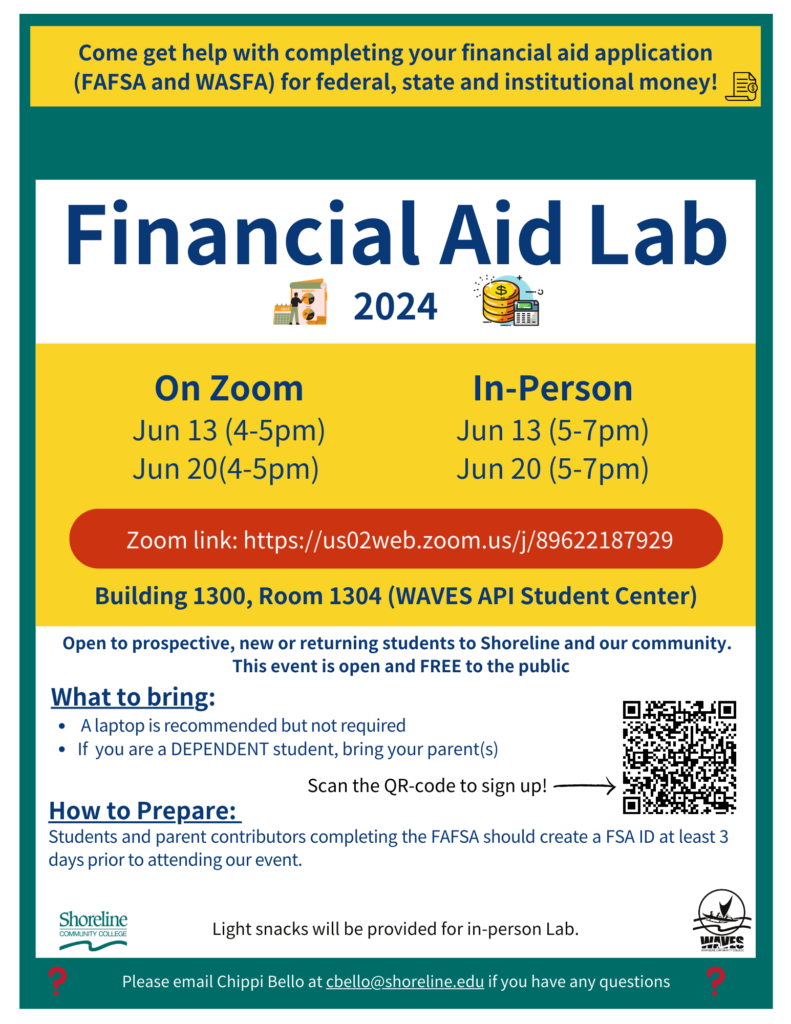

1. **Complete the FAFSA**: The first step in applying for federal student loans is to fill out the Free Application for Federal Student Aid (FAFSA). This form collects information about your financial situation and helps determine your eligibility for federal loans, grants, and work-study programs. You can complete the FAFSA online at the official FAFSA website.

2. **Gather Necessary Documents**: Before starting the FAFSA, gather important documents such as your Social Security number, tax returns, W-2 forms, and bank statements. If you are a dependent student, you will also need your parents' financial information.

3. **Submit Your FAFSA**: After completing the FAFSA, submit it before your state’s deadline to ensure you are considered for all available financial aid. The FAFSA can be submitted as early as October 1st for the following academic year.

4. **Review Your Student Aid Report (SAR)**: Once your FAFSA is processed, you will receive a Student Aid Report (SAR) that summarizes the information you provided. Review it carefully for any errors that need correction.

5. **Receive Your Financial Aid Offer**: After your FAFSA is processed, your school will send you a financial aid offer, which outlines the types of aid you are eligible for, including federal student loans. This offer will also detail the amounts you can borrow.

6. **Accept Your Loans**: If you decide to accept the federal student loans offered to you, follow your school's instructions to formally accept them. This may involve signing a loan agreement and completing entrance counseling.

#### Tips for Maximizing Your Federal Student Loans

- **Understand Your Loan Types**: Familiarize yourself with the different types of federal loans and their terms. Direct Subsidized Loans are need-based and do not accrue interest while you are in school, while Direct Unsubsidized Loans accrue interest from the moment they are disbursed.

- **Borrow Wisely**: Only borrow what you need. While it may be tempting to accept the maximum loan amount, consider your future repayment obligations and living expenses.

- **Stay Informed**: Keep track of any changes in federal student loan policies and repayment options. The U.S. Department of Education frequently updates its guidelines, which can affect your loans.

- **Consider Loan Forgiveness Programs**: If you plan to work in public service or certain non-profit sectors, research loan forgiveness programs that may be available to you.

#### Conclusion

Knowing **where to apply for federal student loans** is just the first step in securing the financial support you need for your education. By understanding the application process and the types of loans available, you can make informed decisions that will benefit you in the long run. Remember to stay organized, keep track of deadlines, and utilize resources available to you, such as financial aid offices and online tools, to ensure a smooth application process. With the right approach, federal student loans can be a valuable resource in achieving your educational goals.