Exploring the Best Options for Loans in Carrollton, GA: Your Ultimate Guide to Financial Solutions

#### Understanding Loans Carrollton GAIn Carrollton, GA, finding the right loan can be a daunting task, especially with the myriad of options available. Whe……

#### Understanding Loans Carrollton GA

In Carrollton, GA, finding the right loan can be a daunting task, especially with the myriad of options available. Whether you are looking for personal loans, auto loans, or home loans, understanding the landscape of loans in Carrollton is crucial for making informed financial decisions. Loans Carrollton GA refers to the various lending options available in this area, tailored to meet the diverse needs of residents.

#### The Types of Loans Available in Carrollton, GA

When it comes to loans in Carrollton, GA, there are several types to consider. Personal loans are often unsecured and can be used for a variety of purposes, from consolidating debt to funding a major purchase. Auto loans, on the other hand, are specifically designed for purchasing vehicles and typically require the vehicle itself as collateral. Home loans, including mortgages, are essential for those looking to buy property and come with various terms and interest rates.

#### Finding the Right Lender in Carrollton, GA

Choosing the right lender is a critical step in the loan process. In Carrollton, GA, borrowers have access to a range of financial institutions, including banks, credit unions, and online lenders. Each lender has its own set of criteria, interest rates, and repayment terms, so it’s essential to shop around. Consider factors such as customer service, loan processing times, and flexibility in repayment options when selecting a lender.

#### Understanding Interest Rates and Terms

Interest rates can significantly impact the overall cost of a loan. In Carrollton, GA, rates may vary based on the type of loan, the lender, and the borrower’s creditworthiness. It’s important to compare rates from different lenders to ensure you are getting the best deal possible. Additionally, understanding the terms of the loan, including the repayment period and any fees associated with the loan, can help you avoid unexpected costs down the line.

#### The Application Process for Loans in Carrollton, GA

The application process for loans in Carrollton, GA, typically involves several steps. First, borrowers need to gather necessary documentation, such as proof of income, employment history, and credit information. Once you have your documents ready, you can apply online or in person at a lender’s office. After submitting your application, the lender will review your information and determine your eligibility. This process can take anywhere from a few hours to a few days, depending on the lender and the type of loan.

#### Tips for Securing a Loan in Carrollton, GA

To improve your chances of securing a loan in Carrollton, GA, consider the following tips:

1. **Check Your Credit Score**: A higher credit score can lead to better interest rates and loan terms.

2. **Prepare Your Financial Documents**: Having all necessary documents ready can streamline the application process.

3. **Consider a Co-Signer**: If your credit is less than stellar, a co-signer can help you qualify for a loan.

4. **Compare Multiple Offers**: Don’t settle for the first offer you receive; compare rates and terms from different lenders.

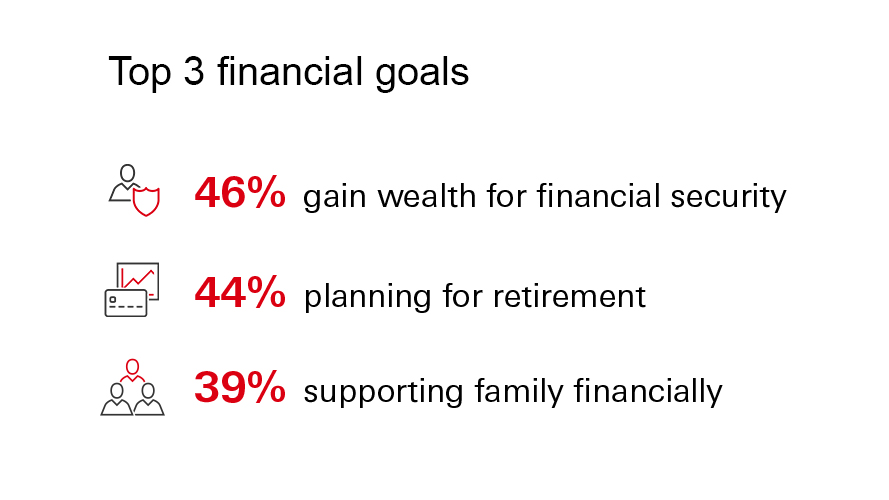

#### Conclusion: Making Informed Decisions About Loans in Carrollton, GA

Navigating the world of loans in Carrollton, GA, doesn’t have to be overwhelming. By understanding the types of loans available, researching lenders, and preparing for the application process, you can make informed decisions that align with your financial goals. Whether you need a personal loan to cover unexpected expenses or an auto loan to purchase a new vehicle, the right loan can help you achieve your financial objectives. Always remember to read the fine print and ask questions to ensure you fully understand the terms of your loan.