Understanding the Benefits of Community Loan Center: Your Path to Financial Empowerment

Guide or Summary:Community Loan CenterWhat is a Community Loan Center?Benefits of Using a Community Loan CenterHow to Access Services at a Community Loan Ce……

Guide or Summary:

- Community Loan Center

- What is a Community Loan Center?

- Benefits of Using a Community Loan Center

- How to Access Services at a Community Loan Center

Community Loan Center

In today’s financial landscape, many individuals and families find themselves in need of accessible funding options. This is where the Community Loan Center comes into play. Designed to cater to the financial needs of local residents, community loan centers offer a range of services that can help bridge the gap between financial challenges and solutions.

What is a Community Loan Center?

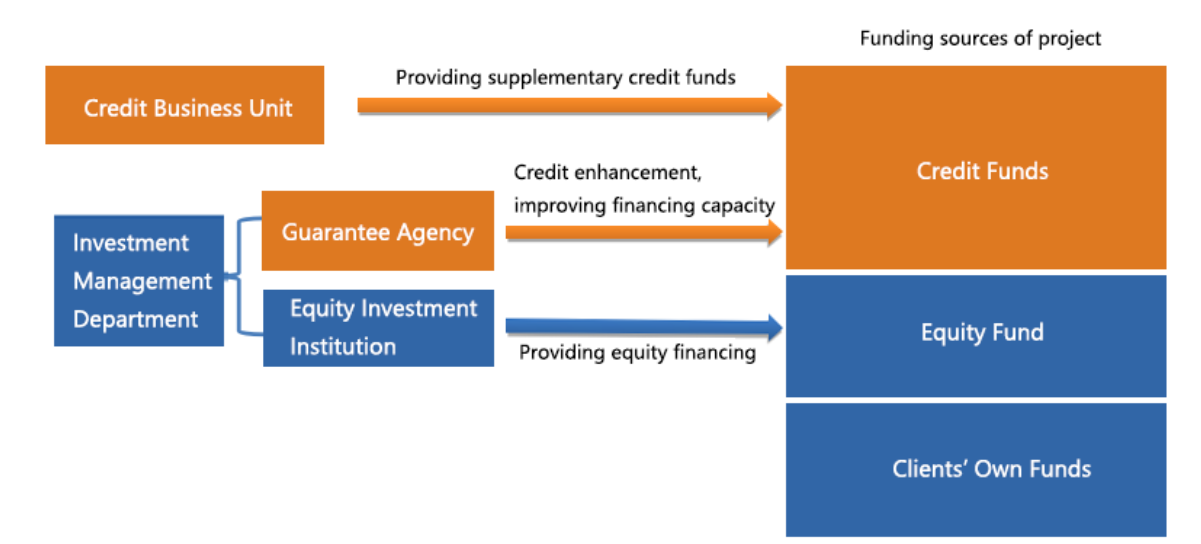

A Community Loan Center is a nonprofit organization that provides affordable loan options to individuals who may not qualify for traditional bank loans. These centers are often rooted in the community, aiming to uplift local residents by offering financial products that are both fair and transparent. Unlike payday loans, which can come with exorbitant interest rates, community loan centers focus on providing loans with reasonable terms and rates, ensuring that borrowers can repay their loans without falling into a cycle of debt.

Benefits of Using a Community Loan Center

One of the most significant advantages of utilizing a Community Loan Center is the accessibility it provides. Many people face financial emergencies, whether it’s unexpected medical bills, car repairs, or other urgent expenses. Traditional banks may have strict lending criteria, leaving many individuals without options. Community loan centers, on the other hand, often have more lenient requirements, making it easier for individuals to obtain the funds they need.

Another benefit is the personalized service that community loan centers provide. Staff members are usually trained to understand the unique financial situations of their clients. They can offer tailored advice and support, helping borrowers navigate their financial challenges effectively. This level of service fosters a sense of trust and community, which is often lacking in larger financial institutions.

How to Access Services at a Community Loan Center

Accessing services at a Community Loan Center is typically straightforward. Most centers have a simple application process that can be completed online or in person. Applicants will need to provide basic information about their financial situation, including income, expenses, and the purpose of the loan. Once the application is submitted, the center will review it and determine eligibility.

It’s important to note that community loan centers often prioritize financial education. Many offer workshops and resources that help borrowers understand their financial health, budgeting, and responsible borrowing practices. This educational component is crucial, as it empowers individuals to make informed financial decisions in the future.

In conclusion, the Community Loan Center serves as a vital resource for individuals seeking financial assistance. By offering affordable loans and personalized support, these centers play a crucial role in promoting financial stability within communities. Whether you’re facing a short-term financial challenge or looking to build a stronger financial future, a community loan center may be the solution you need. Embrace the opportunity to access financial resources that prioritize your well-being and help you navigate life’s unexpected challenges.